How to Improve Your Credit Score for Better Loan Offers

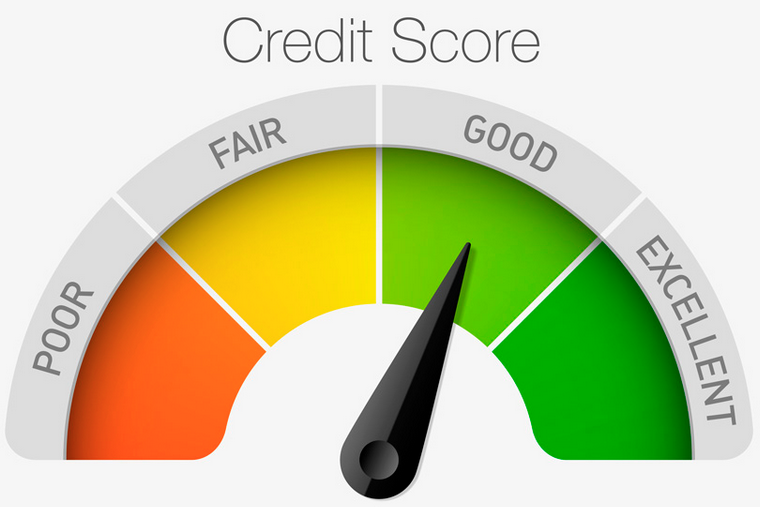

Your credit score plays a crucial role in determining your loan eligibility and the interest rates you receive. A higher score means better loan offers, lower interest rates, and easier approvals. At Eze Loans, we’re here to help you understand and improve your credit score for a stronger financial future.

1. Check Your Credit Report Regularly

Start by reviewing your credit report for errors or inaccuracies. A simple mistake could be lowering your score without you realizing it. If you spot any discrepancies, dispute them with the credit bureau immediately.

2. Pay Your Bills on Time

Payment history is the biggest factor affecting your credit score. Set up automatic payments or reminders to ensure you never miss a due date on credit cards, loans, or utility bills.

3. Reduce Your Credit Utilization

Using too much of your available credit can hurt your score. Aim to keep your credit utilization below 30% of your total credit limit. If possible, pay off outstanding balances instead of just making the minimum payment.

4. Avoid Opening Too Many New Accounts

Every time you apply for a loan or credit card, a hard inquiry is recorded on your credit report. Too many inquiries in a short time can lower your score. Be strategic about new credit applications.

5. Keep Old Credit Accounts Open

The length of your credit history matters. Even if you no longer use an old credit card, keeping it open (with a low or zero balance) can help maintain a longer credit history, which boosts your score.

6. Diversify Your Credit Mix

Having a mix of credit types—such as credit cards, personal loans, or mortgages—can positively impact your score. However, only take on new credit when necessary and manageable.

7. Pay Off Debt Strategically

Prioritize paying off high-interest debt first while maintaining minimum payments on other accounts. Debt consolidation loans can also be a great way to manage multiple debts efficiently.

Get Better Loan Offers with Eze Loans

A better credit score means better loan options. At Eze Loans, we offer personalized loan solutions to match your financial goals. Whether you’re looking for a personal loan, car loan, or mortgage, we’ll help you find the best rates available.